LUN Partners Group

LUN Partners Group is an Asia-based global investment firm founded in 2016. LUN Partners Group primarily invests in FinTech and other high-growth digital technology companies around the world.

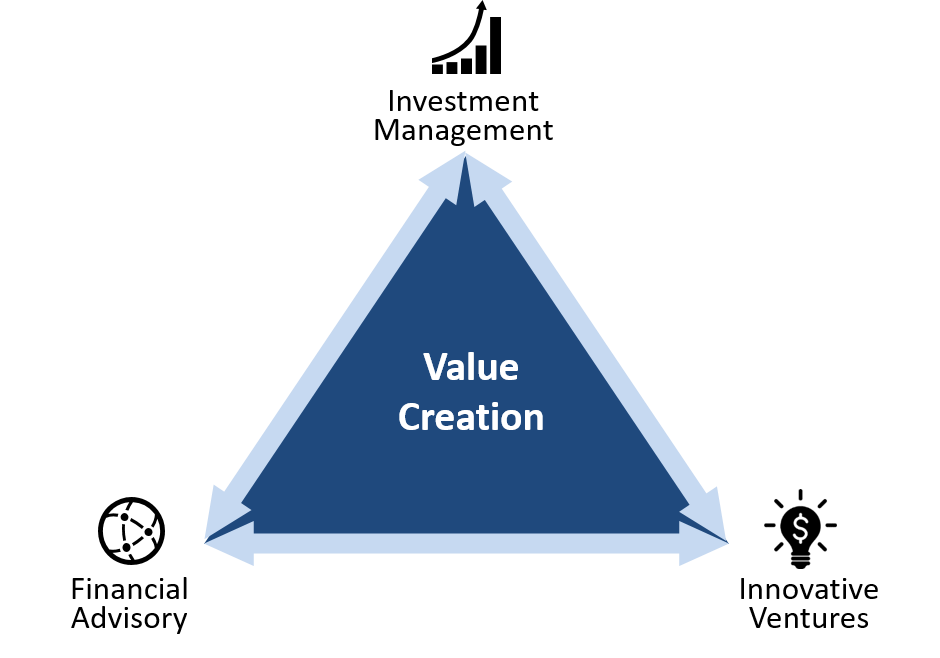

LUN Partners takes a hands-on approach in value creation for its portfolio companies by providing strategic planning, M&A advisory, and support for new market entry. LUN Partners aims to create long-term value for investors, portfolio companies, and society by fostering collaborative development and synergistic partnerships within its ecosystem of innovative companies. Today, our portfolio companies and strategic partners span North America, South America, Asia, Europe, and Africa.

Our team members come from top international investment firms and possess extensive experience in investment management, cross-border M&A, and international corporate development. Our offices are located in Hong Kong, Shanghai, and Tokyo.

Follow Us